Types Of Variable Cost In Accounting . variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. A variable cost is an expense that changes in proportion to production output or sales. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. Variable costs differ from fixed costs, which don’t fluctuate. Tvc = total quantity of output * vc per unit of output. a variable cost is any corporate expense that changes along with changes in production volume. As production increases, these costs. examples of variable costs include direct labor, direct materials, commissions, and utility costs.

from www.floridatechonline.com

the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. As production increases, these costs. Variable costs differ from fixed costs, which don’t fluctuate. examples of variable costs include direct labor, direct materials, commissions, and utility costs. Tvc = total quantity of output * vc per unit of output. A variable cost is an expense that changes in proportion to production output or sales. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. a variable cost is any corporate expense that changes along with changes in production volume.

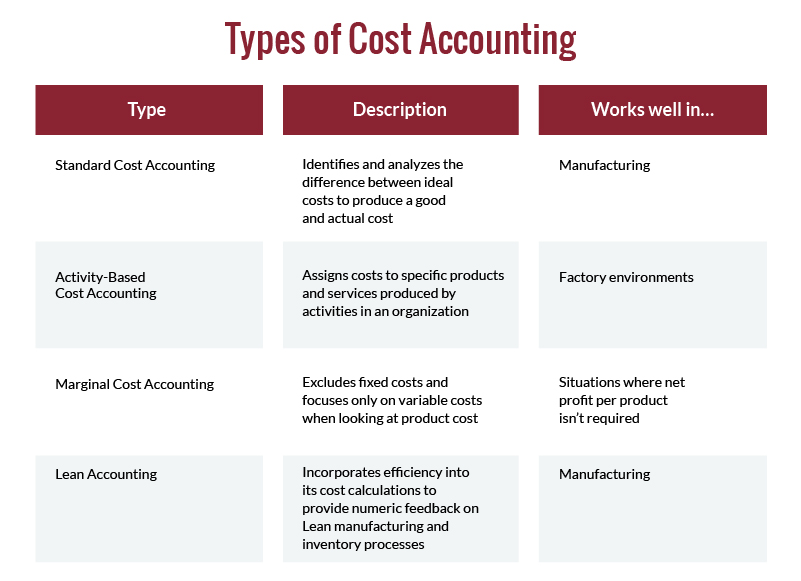

What is Cost Accounting?

Types Of Variable Cost In Accounting Tvc = total quantity of output * vc per unit of output. a variable cost is any corporate expense that changes along with changes in production volume. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. Tvc = total quantity of output * vc per unit of output. examples of variable costs include direct labor, direct materials, commissions, and utility costs. Variable costs differ from fixed costs, which don’t fluctuate. A variable cost is an expense that changes in proportion to production output or sales. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. As production increases, these costs.

From cashflowinventory.com

A Guide to Inventory Cost Management to Boost Your Profits Types Of Variable Cost In Accounting Tvc = total quantity of output * vc per unit of output. Variable costs differ from fixed costs, which don’t fluctuate. a variable cost is any corporate expense that changes along with changes in production volume. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. As production increases,. Types Of Variable Cost In Accounting.

From www.iedunote.com

Cost Behavior Fixed, Variable and Mixed Cost Types Of Variable Cost In Accounting Tvc = total quantity of output * vc per unit of output. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. examples of variable costs include direct labor, direct materials, commissions, and utility costs. the types of costs evaluated in cost accounting include variable costs,. Types Of Variable Cost In Accounting.

From dxonqlntu.blob.core.windows.net

Variable Costs And Fixed Costs at Eddie Matthews blog Types Of Variable Cost In Accounting a variable cost is any corporate expense that changes along with changes in production volume. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. As production. Types Of Variable Cost In Accounting.

From study.com

Variable Cost Definition, Formula & Examples Lesson Types Of Variable Cost In Accounting the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. a variable cost is any corporate expense that changes along with changes in production volume. As production increases, these costs. Variable costs differ from fixed costs, which don’t fluctuate. Tvc = total quantity of output * vc per unit. Types Of Variable Cost In Accounting.

From dxowwwyvj.blob.core.windows.net

Variable Costs Per Unit Formula at Frank Argueta blog Types Of Variable Cost In Accounting a variable cost is any corporate expense that changes along with changes in production volume. Variable costs differ from fixed costs, which don’t fluctuate. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. examples of variable costs include direct labor, direct materials, commissions, and utility costs. Tvc. Types Of Variable Cost In Accounting.

From gioviuhws.blob.core.windows.net

Types Of Overheads In Cost Accounting at Erica Spiker blog Types Of Variable Cost In Accounting a variable cost is any corporate expense that changes along with changes in production volume. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. A variable cost is an expense that changes in proportion to production output or sales. examples of variable costs include direct. Types Of Variable Cost In Accounting.

From quickbooks.intuit.com

Operating Costs Definition, Formula & Examples QuickBooks Types Of Variable Cost In Accounting As production increases, these costs. examples of variable costs include direct labor, direct materials, commissions, and utility costs. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. Variable costs differ from fixed costs, which don’t fluctuate. a variable cost is any corporate expense that changes along with. Types Of Variable Cost In Accounting.

From www.youtube.com

How to Calculate Variable Cost Ratio Easy Way YouTube Types Of Variable Cost In Accounting examples of variable costs include direct labor, direct materials, commissions, and utility costs. A variable cost is an expense that changes in proportion to production output or sales. As production increases, these costs. a variable cost is any corporate expense that changes along with changes in production volume. variable costing is a concept used in managerial and. Types Of Variable Cost In Accounting.

From courses.lumenlearning.com

5.1 Cost Behavior Vs. Cost Estimation Managerial Accounting Types Of Variable Cost In Accounting a variable cost is any corporate expense that changes along with changes in production volume. examples of variable costs include direct labor, direct materials, commissions, and utility costs. Variable costs differ from fixed costs, which don’t fluctuate. As production increases, these costs. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs,. Types Of Variable Cost In Accounting.

From www.youtube.com

SemiVariable Costs (part 1) High Low method ACCA Management Types Of Variable Cost In Accounting a variable cost is any corporate expense that changes along with changes in production volume. Tvc = total quantity of output * vc per unit of output. As production increases, these costs. examples of variable costs include direct labor, direct materials, commissions, and utility costs. variable costing is a concept used in managerial and cost accounting in. Types Of Variable Cost In Accounting.

From 1investing.in

Variable Cost Explained in 200 Words India Dictionary Types Of Variable Cost In Accounting a variable cost is any corporate expense that changes along with changes in production volume. Tvc = total quantity of output * vc per unit of output. examples of variable costs include direct labor, direct materials, commissions, and utility costs. As production increases, these costs. A variable cost is an expense that changes in proportion to production output. Types Of Variable Cost In Accounting.

From finmark.com

A Simple Guide to Budget Variance Finmark Types Of Variable Cost In Accounting examples of variable costs include direct labor, direct materials, commissions, and utility costs. Tvc = total quantity of output * vc per unit of output. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. A variable cost is an expense that changes in proportion to production output or. Types Of Variable Cost In Accounting.

From giocerggy.blob.core.windows.net

What Are The Types Of Cost System at Howard Swoboda blog Types Of Variable Cost In Accounting Tvc = total quantity of output * vc per unit of output. examples of variable costs include direct labor, direct materials, commissions, and utility costs. A variable cost is an expense that changes in proportion to production output or sales. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is. Types Of Variable Cost In Accounting.

From benjaminwann.com

8 Types Of Cost In Cost Accounting Types Of Variable Cost In Accounting A variable cost is an expense that changes in proportion to production output or sales. a variable cost is any corporate expense that changes along with changes in production volume. As production increases, these costs. examples of variable costs include direct labor, direct materials, commissions, and utility costs. variable costing is a concept used in managerial and. Types Of Variable Cost In Accounting.

From www.youtube.com

Cost Classifications Managerial Accounting Fixed Costs Variable Types Of Variable Cost In Accounting examples of variable costs include direct labor, direct materials, commissions, and utility costs. Tvc = total quantity of output * vc per unit of output. Variable costs differ from fixed costs, which don’t fluctuate. A variable cost is an expense that changes in proportion to production output or sales. a variable cost is any corporate expense that changes. Types Of Variable Cost In Accounting.

From www.investopedia.com

Variable Cost What It Is and How to Calculate It Types Of Variable Cost In Accounting examples of variable costs include direct labor, direct materials, commissions, and utility costs. a variable cost is any corporate expense that changes along with changes in production volume. A variable cost is an expense that changes in proportion to production output or sales. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct. Types Of Variable Cost In Accounting.

From vaughnkruwhunt.blogspot.com

Cost Classification in Management Accounting Pdf VaughnkruwHunt Types Of Variable Cost In Accounting a variable cost is any corporate expense that changes along with changes in production volume. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. A variable cost is an expense that changes in proportion to production output or sales. examples of variable costs include direct. Types Of Variable Cost In Accounting.

From dxoydaqjj.blob.core.windows.net

Home Office Expenses Maintenance at Lyle McKay blog Types Of Variable Cost In Accounting Tvc = total quantity of output * vc per unit of output. variable costing is a concept used in managerial and cost accounting in which the fixed manufacturing overhead is excluded from the. the types of costs evaluated in cost accounting include variable costs, fixed costs, direct costs, indirect costs, operating costs,. Variable costs differ from fixed costs,. Types Of Variable Cost In Accounting.